Category: INSIGHTS

There’s no denying the growing popularity of retail investing in the USA. In 2023, it reached a high when it accounted for approximately 23% of trading volume in one week. Even though those figures dipped slightly after this high, retail investing continues to attract beginners and experienced investors alike.

To gain a deeper understanding of the topic, we analyzed feedback from 853,138 retail stock investors in the USA over 12 months, ending on March 17, 2025. We did this by leveraging AI-driven audience profiling to synthesize insights from online opinions to a high statistical confidence level.

Our findings highlight the most popular platforms for retail investing, the most common reasons for investing in retail, which are the most invested assets, the biggest challenges and concerns associated with retail investing, and other factors. Let’s take a look at what our data revealed.

Index

- 60% retail stock investors in the USA use Robinhood the most

- For 82% retail stock investors, passive income is the main reason for investing

- ETFs the most invested assets for 73% retail stock investors

- 33% of retail investors said their biggest challenge was understanding market trends

- Inflation the biggest concern about the stock market in the next year for 56%

- Day trading is the preferred investment strategy of 46% of our audience

- 51% of retail investors said diversification is essential for managing investment risks

- 44% of our audience research opportunities with the help of investment newsletters

- 94% of retail stock investors follow financial influencers online

- 46% of our audience think AI has a positive impact on investment decisions

- 50%of retail investors said financial education was very important in their investing journey

- 81% say AI-driven insights could help them make better investment decisions

- 85% of retail investors consider ESG when making investment decisions

- 92% retail stock investors reside in the Midwest

- Retail Investing On The Rise

- Methodology

Which Investment Platforms Do You Use Most Often?

60% retail stock investors in the USA use Robinhood the most

While Robinhood is the most popular investment platform among our audience, it’s by no means the only one:

While relatively basic, Robinhood has offerings that many other platforms don’t, and there are no minimum required investments or trading commissions. This may explain why 60% of retail stock investors use Robinhood most often. It’s worth noting that Robinhood Markets, along with Fidelity and Merrill Edge, topped the list of the Investor’s Business Daily (IBD) 13th annual Best Online Brokers Survey.

That said, our findings were somewhat different from the IBD survey. Preferred by 18% of our audience, Charles Schwab was the second most popular platform, followed by E*TRADE, which found a devoted following among 13% of retail investors in the USA. One of the more complex platforms, TD Ameritrade allows users to trade stocks, ETFs, mutual funds, options, futures, and a few fixed-income options. However, this comes with a higher entry bar, which may explain why only 4% of our audience said they use the platform often. The rest of our audience said they use various popular platforms (2%) and Fidelity (2%).

What Is Your Primary Reason For Investing?

For 82% retail stock investors, passive income is the main reason for investing

While the majority of our audience invest primarily to earn a passive income, some of our audience had slightly different reasons:

Our data shows that, as was to be expected, making money is the primary reason why retail stock investors invest. What this means, however, varies from person to person.

For 82%, earning a passive income is their main reason for retail investing. This is in keeping with Statista’s finding that more than 90% of US retail investors say that future growth potential was a driving factor when it came to making investment decisions.

The responses of the rest of our audience were also consistent with Statista’s data, even if individual goals differed slightly. 11% said they were focused on long-term wealth, while 5% said they aimed at making a profit in the short term. For 2% of the audience, wealth building, whether long or short, was their primary reason for investing.

What Type Of Assets Do You Invest In The Most?

ETFs the most invested assets for 73% of retail stock investors

As you can see, the rest of our audience prefers cryptocurrency, stocks, mutual funds, and bonds:

At 73%, the majority of retail stock investors said they mostly invest in exchange traded funds (ETFs). It’s easy to see why ETFs continue to be a popular choice. One reason for their popularity is that they’re more tax-efficient than securities bought and sold within mutual funds. They also have lower costs relative to mutual funds. While investors may pay commissions to buy or sell ETFs, they don’t need to worry about distribution fees.

17% of retail investors in the US said they mostly invested in cryptocurrency. Surprisingly, this finding was significantly different from those of an EY Parthenon survey published in 2024. According to the EY survey, 72% of respondents said that cryptocurrency was a key component of their wealth strategy. EY also found a 46% increase in ‘active’ uses of crypto, such as trading, payments, and staking, and a 36% decrease in ‘passive’ uses, such as long-term investment.

Stocks were preferred by 6% of our audience, while 3% said they mostly invested in mutual funds. Less than 1% said they often invested in bonds.

What Is Your Biggest Challenge When Investing?

33% of retail investors said their biggest challenge was understanding market trends

Investing comes with numerous challenges, including:

For 33% of investors in the US, understanding market trends was the biggest challenge when investing. This sentiment was echoed by the 25% who struggled to access reliable investment advice, 3% who said that not understanding trends was a challenge, and another 3% who said their biggest challenge was finding reliable information.

If we take a step back for a broader view of this, it’s clear that a lack of knowledge and understanding is the main challenge for more than half of our audience.

Our findings back up some of those in the World Economic Forum’s (WEF) Global Retail Investor Outlook 2024. According to WEF, retail investors are opting to invest in products that are more accessible and easier to understand than bonds, stocks, ETFs, mutual funds, and other traditional investments. The WEF survey found that 29% of investors said they avoided stocks due to a lack of understanding, while 24% said they avoided crypto for the same reason. The biggest challenge for the non-investors surveyed by WEF included a lack of funds and fear of financial loss, with more than 50% saying they would feel more confident about investing if they had learned about it in school.

The challenge of a lack of funds was also something felt by our audience, with 28% saying their biggest obstacle was access to capital. Other challenges included risk management (5%) and managing emotions (3%). A City Index survey of 3,000 US-based investors revealed that 35% of them said their trading decisions were consistently influenced by their emotions.

What Is Your Biggest Concern About The Stock Market In The Next Year?

Inflation the biggest concern about the stock market in the next year for 56%

Retail stock investors are concerned about economic recession, market volatility, and other factors:

Able to weaken the purchasing power of investments to the point where they decline in real value, inflation is the biggest concern about the stock market in the next year for 56% of retail stock investors. Unsurprisingly, given the link between higher interest rates and a slower economy, 30% of our audience is concerned about economic recession, while 6% expressed concern about interest rates.

These fears may be justified: a 2025 Deutsche Bank survey indicated that there’s an approximately 40% chance that the US is heading for a recession. 9% of our audience expressed concerns about market volatility.

The retail investors comprising our audience weren’t the only ones with concerns about the stock market over the next year. An Investopedia survey found that 61% of respondents were worried or somewhat worried about recent market events. More than 40% said they expected another significant drop for the S&P 500 in the next few months, while 33% said they were investing less in the stock market. 26% said they increased their investment in money market funds.

What Investment Strategy Do You Prefer?

Day trading is the preferred investment strategy of 46% of our audience

Delve into what our data says about our audience’s preferred investment strategies:

For 46% of retail stock investors, day trading is their preferred strategy. However, this may not be the best approach as an Investopedia article claims that only between 3% and 20% of day traders make money.

Despite the relatively poor returns, this strategy remains popular partly due to impressions created by the media, which portray it as an easy way to make millions of dollars within a single trading day.

Preferred by 18% of our audience, buy and hold was the next most popular investment strategy, followed by swing trading (16%) and long-term (9%). 5% said they opted for growth investing, while another 5% turned to value investing. Only 1% of our audience said they preferred short-term trading.

How Do You Manage Investment Risks?

51% of retail investors said diversification is essential for managing investment risks

The graph below shows the different ways in which our audience manages investment risks:

For 51% of our audience of retail investors, diversification was essential for managing investment risks. Interestingly, an HSBC survey revealed that 36% of investors find it difficult to monitor and manage a diversified portfolio.

As for the rest of our audience, 42% said that long-term investing was effective, while 6% turned to stop-losses, and 1% said that hedging was their essential risk management strategy.

How Do You Research Investment Opportunities?

44% of our audience research opportunities with the help of investment newsletters

Our audience turns to different sources, from newsletters and social media to friends and family, to research investment opportunities:

Often featuring sound advice, investment newsletters were the preferred method of researching investment opportunities for 44% of our audience, while 18% said they used financial news sites. However, social media actually proved more popular for research, as this was preferred by 20% of retail investors.

The popularity of social media was also picked up by an IR survey, which found that 22% of the investors it surveyed made investment decisions based on digital promotions or celebrity endorsements they saw on social media.

While 8.9% of our audience said they used stock screeners, 5% said they did thorough research, and another 5% said they turned to friends and family. This last result was far more conservative than the IR survey’s 37% of investors who relied on the recommendations of family and friends.

Do You Follow Financial Influencers Or Investment Advisors Online?

94% of retail stock investors follow financial influencers online

It’s clear that financial influencers have a following, but the frequency differs dramatically:

Our data shows that an incredible 94% of retail investors in the US follow financial influencers or finfluencers on social media, with 6% following them frequently. This finding is noticeably higher than that of a FINRA report published a few years ago, which indicated that 60% of investors under the age of 35 used social media as an information source. Finfluencers are one of the reasons why young people have started investing. According to CFA Institute research, 37% of Gen-Z investors said finfluencers were a major factor in their decision to start investing.

How Do You Feel About The Impact Of AI on Investment Decisions?

46% of our audience think AI has a positive impact on investment decisions

Our audience’s opinions about AI’s impact on investment decisions are divided:

At 46%, slightly less than half of our audience thinks that AI has a positive impact on investment decisions, followed by 20% who said that the impact is somewhat positive. The use of AI in making investment decisions appears to be gaining traction. According to Statista, in 2023, approximately 20% of retail investors used AI for financial research, while 50% said they were interested in using AI.

However, perceptions of using AI for investment decisions weren’t entirely positive. 14% of retail stock investors said AI’s impact had been somewhat negative, compared with 13% who said the impact was negative and 8% who said the impact was very negative.

How Important Is Financial Education In Your Investing Journey?

50% of retail investors said financial education was very important in their investing journey

All 853,138 retail stock investors recognize the importance and value of financial education to varying degrees:

For 50% of US-based retail investors, financial education was a very important factor in their investing journey. Their sentiments were echoed by 25% who said it was crucial for success and another 25% who said it’s crucial for retail.

Despite a recognition of the value of financial education among our audience, many American adults have never received any. According to the World Economic Forum, approximately 50% of adults in the US are financially literate – a figure that has dropped by 2% over the last two years.

Thankfully, the importance of financial literacy is not lost on younger people who will become the next generation of retail investors. A recent Intuit survey found that while most high school students rely on their parents for financial knowledge, 85% of them are interested in learning about financial topics at school, while 95% of students who currently receive financial curriculum find it helpful.

What Additional Resources Or Tools Would Help Improve Your Investment Decisions?

81% say AI-driven insights could help them make better investment decisions

From AI and coaching to improved platforms and educational content, various additional resources can improve investment decisions:

As AI continues to take the world by storm, it’s no surprise that 81% of retail stock investors said that it would help improve their investment decisions – and it’s not only our audience who feel this way. According to Mercer, 54% of managers are currently using AI within their investment strategy or asset class research, while 37% are planning to do so.

While AI dominated responses, it wasn’t the only additional resource that would help with better decision-making. Other resources they named include personalized coaching (7%), better platforms (7%), and more educational content (4%).

Do You Consider ESG Environmental Social Governance Factors When Making Investment Decisions?

85% of retail investors consider ESG factors when making investment decisions

Our entire audience usually considers ESG factors when making investment decisions:

Our data makes it clear that environmental social governance (ESG) factors are important to our entire audience of retail investors in the US. However, whether these factors influence their every investment decision is another matter. While 85% said they consider ESG in their investment decisions, it was only 16% who said they always consider ESG when making decisions.

By comparison, the 2024 Institutional Investor Survey on Sustainability found that 67% of investors consider ESG quality among other factors when making an investment decision, with 2% using it to screen out potential investments. 41% of their respondents said that ESG wasn’t important.

Where In The USA Do You Primarily Reside?

92% retail stock investors reside in the Midwest

Find out in the graph below which other region was represented among our retail investor audience:

92% of our audience reside primarily in the USA’s Midwest, with 8% residing in the Northeast. While this may be surprising for some who expected the Northeast or Southwest to feature more prominently, it’s less so when you consider the surprising growth shown in the Midwest over the last couple of years.

Retail Investing On The Rise

Relatively accessible to beginners thanks to various platforms and apps such as Robinhood, retail investing continues to grow in popularity. Whether they aim for short-term profits or building wealth over the long term, retail investors have a variety of options to choose from, such as ETFs and cryptocurrency, to stocks and bonds.

However, as some people who are new to investing have discovered, being able to access these options is one thing, but understanding trends and overcoming various challenges is quite another. There’s no substitute for good financial education, although advice from advisors and financial influencers can help with making decisions, as can help. As social media and AI continue to shape the sector, retail investing should become even more accessible and popular than it already is.

Methodology

Sourced from an independent sample of 853,138 retail stock investors in the USA across X, Bluesky, Reddit, TikTok, and Threads. Responses are collected within a 95% confidence interval and 3% margin of error. Engagement estimates how many people in the location are participating. Demographics are determined using many features, including name, location, and self-disclosed description. Privacy is preserved using k-anonymity and differential privacy. Results are based on what people describe online — questions were not posed to the people in the sample.

About the representative sample:

- 57% of retail stock investors in the USA are over the age of 45 years old.

- 61% identify as male.

- 43% earn between $200,000 and $500,000 annually.

Investing in stocks, shares, and other assets has always been an intriguing avenue for individuals seeking to grow their wealth. And if you’re reading this, more than likely, they interest you too.

With a sample size of 2,000 participants, our survey aimed to delve deep into these individuals’ investment preferences and behaviours. By exploring the statistics derived from our survey, we can gain valuable insights into the investment landscape, identify emerging trends, and inform investment strategies.

- Overview

- Overall: What are people interested investing in?

- Age Defined Investment Choice

- Gender Investment Preference

- Regional Distribution

- Methodology & Caveats

Overview

This comprehensive report reveals a wealth of meticulously gathered facts, figures, and numerical representations. However, for those seeking an immediate breakdown, we have distilled the findings into a concise yet impactful summary below:

- Stocks, Shares, and ETFs are the preferred investment assets (86%).

- Despite their high-risk nature, cryptocurrencies attract 52% of individuals, particularly among the younger generation.

- Options, Futures, CFDs, and Forex are less favoured, possibly due to their complex concepts, with nearly 50% less people showing interest in them compared to stocks and shares.

- Older individuals show less inclination towards cryptocurrency investments, with just 8% interested over the age of 65.

- Property investment interest increases by 6% from the average during the mid-stage of life.

- Forex trading garners the most interest from individuals aged 18 to 24, with 45% showing their interest.

- Investment interest is relatively balanced between genders, with a slight male preference of just 4.3%.

- Londoners exhibit an above-average inclination towards investments.

The Overall Picture: What Are People Interested in Investing in?

The survey results reveal insights into the investment preferences of the surveyed individuals. Across the board, the most popular investment options in 2023 were stocks, shares, ETFs and Tracker Funds.

86% of people within the survey ticked the box that they are interested in or have invested in these assets. Cryptocurrencies were found to be the second most enticing asset class. With 52% of the participants having invested or are interested in this asset class.

Lagging at the bottom of groups were Options/Futures/CFDs (grouped under one category) and Forex, with just 27% and 29% of people ticking this box retrospectively.

What These Statistics Tell Us

- The highest proportion of people are interested in low-risk assets such as Stocks, Shares and EFTs.

- Despite cryptocurrency being a high-risk asset, people seem to be interested in these novel investment opportunities’ high-risk, high-reward outcomes.

- Options, Futures, CFDs and Forex are not very popular, likely because these assets require previous investment knowledge to understand their concepts.

Age Defined Investment Choices

The survey data shows the relationship between age and investment preferences among the surveyed individuals. By examining the age distribution, we can identify patterns and understand how different age groups engage in investing.

Across all age ranges, the majority of respondents expressed interest in or had invested in stocks, shares, ETFs, or tracker funds. The highest percentage was observed in the 45 to 54 age range, with 94% indicating a strong interest in these investment options. However, interest was slightly decreased among the 25 to 34 age group (82%).

The interest in cryptocurrencies varied across age groups. The highest percentage of interest was seen among the younger age ranges, with 66% of respondents aged 18 to 24 and 25 to 34 showing interest or having invested in cryptocurrencies. The interest gradually declined among older age groups, with only 8% of respondents aged 65 and over expressing interest.

The interest in bonds and gilts remained relatively consistent across different age groups. While property or real estate investment showed a similar trend to bonds and gilts, with a slight increase among mid-tier age groups. The highest percentage of interest was observed in the 35 to 44 age range (46%), while the lowest interest was seen among respondents aged 65 and over (15%).

What These Statistics Tell Us

- The older people get, the less inclined they become to invest in high-risk assets such as Cryptocurrency.

- Most people start thinking about investing in property during their mid-stage of life.

- Younger people are most likely to be thinking about investing.

- Participants most likely to trade forex are between the ages of 18 and 24.

Gender Investment Preferences

We also looked at gender preferences between different asset classes. Understanding gender inclinations can be helpful in seeing which gender is best to target for your business.

Stocks/Shares/ETFs/Tracker Funds are favoured by 83% of females and 88% of males — only a 5% different, which isn’t that significant considering the sample size. Cryptocurrency interest showed a more considerable discrepancy between males and females, with 8% more men opting for these investments.

At the other end of the sale, lesser attractive assets, such as Forex, Options, Futures and CFDs, were all favoured by men. Property was the only asset class valued higher for females than males. However, the difference was only 1%.

What These Statistics Tell Us

- There is a roughly equal likelihood of males and females investing, with a slight predisposition of interest tilted towards males.

UK Regional Distribution Investment Stats

According to the data, certain regions have shown a higher than average interest in specific investment options.

London, for instance, stands out with a strong inclination towards traditional investment options like stocks, shares, ETFs, and tracker funds, with an interest rate of 85%. Additionally, London demonstrates a notable interest in cryptocurrencies, with a higher interest rate of 65%, reflecting a keenness for digital assets and blockchain technology.

Despite a relatively lower overall interest, Northern Ireland still exhibits considerable interest in traditional investment avenues, such as stocks, shares, ETFs, and tracker funds. The region also shows a higher interest rate of 50% in property and real estate investments, indicating a focus on the local housing market.

It’s important to consider that these regional differences in investment interests may be influenced by factors such as economic conditions, market trends, and regional dynamics.

What These Statistics Tell Us

- Londoners tend to have a higher than average investment preference.

The Bottom Line: Is Investing Dead?

From looking at the numbers above, it’s no surprise that investing is certainly not dead. If anything, it is becoming more popular and accessible as the years go on.

FinTech companies are popping up all over the place where people can invest money directly through apps on their mobiles. There’s also a lower barrier to entry with an unimaginable amount of information on the internet to guide novice investors through their investment journey.

If you want to get first access to the latest investment tips, click ‘Send Me Tips Tyson’, and I’ll send you everything I’ve got from my data-driven approach to investing.

Methodology & Caveats

To conduct our survey, we collaborated with OnePoll, an established research company known for its expertise in data collection. OnePoll administered the survey on our behalf, targeting a sample size of 2,000 individuals selected from their own panel. The panel utilized by OnePoll is designed to be demographically representative, ensuring that the survey results accurately reflect the broader UK population aged 18 and above.

Our decision to partner with OnePoll was based on their commitment to upholding industry standards and ethical guidelines. They strictly adhere to the Market Research Society (MRS) Code of Conduct and the ESOMAR principles, which govern fair and accurate data collection practices.

While we made every effort to ensure the reliability and validity of our survey findings, it is important to consider certain limitations associated with our methodology:

- Sampling: Although the panel was designed to be demographically representative, there was a potential for sampling bias, as individuals who choose to participate in online surveys may differ from those who do not.

- Self-Selection Bias: Respondents who opted to participate might possess different opinions or behaviors compared to those who declined to take part.

- Response Bias: Respondents may be influenced by social desirability bias or other factors, leading to responses that do not fully reflect their true beliefs or behaviors.

There’s no shortage of books, websites and stock tip newsletters and clubs out there, especially online all claiming they can give you superior returns. They all claim they can do better than the market, and of course I’m no different in that regard.

However, where I am different, compared to what I’ve read online, is in the approach I take in evaluating strategies for stock selection and market timing. And this is my first post to help explain my approach to equities investments.

S&P 500 returns

Today, we’ll start with the US market. Every investor not satisfied with a fund wants to beat the market. The S&P 500, the top 500 stocks in the USA by market capitalisation, has returned 51% in the last 5 years. So 1,000 USD invested would have grown into 1,510 USD. This represents a Compounded Annual Growth Rate (CAGR) of 8.6%. As annual returns go, it doesn’t sound terribly exciting for a lot of people yet that’s the power of compounding.

The Rule of 72

In fact, as a quick aside, if you’re ever wondering how long it will take to double your money or what rate you’d require to double in a given time period, use the rule of 72!

Here’s how it works:

You’re earning 9% annual returns every year and want to know how long it will take to double your money, using the rule:

72 / 9 = 8 years

It also works in reverse. You want to double your money in 3 years, what CAGR rate will you require?

72 / 3 years = 24

Which is 24% every year for 3 years

It’s not exact and yet it’s a reasonable rough estimate.

Back to CAGRs

Beating the S&P500 is the ultimate aim of most if not all active investors. I asked over 10 people in passing the minimum return they’d required to invest in a hedge fund and the answer was always 10%.

It doesn’t like much more than the S&P500 market of 8.6% but it’s actually 16% better. So instead of doubling your money in 8 years, it’s doubled a year earlier in 7.

Naturally, there’s very little risk in putting money into the S&P 500 compared to selecting your own stocks as you’re effectively buying ‘America’.

So to my mind, for the risk involved a fund or service like this one should deliver returns of 16% or more. Thus, quite a bit of research is required on my side to make sure that any recommendations made pass a number of tests.

Why I don’t backtest

According to google, backtesting is the general method for seeing how well a trading strategy would have performed in hindsight using historical data.

If backtesting works, then traders will usually have the confidence to employ it going forward.

In most scenarios, and despite the sophistication of methods to signal when to buy and sell, it’s very difficult to beat the buy and hold strategy. Most of these are based on the speed of stock prices moving averages and get it mostly horribly wrong!

Take the S&P 500 shown below:

History simply doesn’t repeat itself in the same way, so I prefer to use probability which I’ll explain a bit more later.

The ones that get it right are either lucky, know what they’re doing or both! There is most definitely a place for back testing, I prefer a different approach.

The distribution of returns

Given the reason we are here is to increase our ultimate wealth, my decisions revolve around maximising the average CAGR per year over the long term (over 20 years).

Why? Because it’s more robust, and it means that you don’t care too much about short term fluctuations even if they are a bit annoying!

I also like the idea of knowing the average CAGR so that I can use the rule of 72 to get a quick idea of when my money is likely to be doubled.

As mentioned earlier, I prefer probability. Warren Buffet recently said in his recent 2022 Berkshire Hathaway conference that the stock market has become a gambling parlour. You don’t say Warren!

In my view, it always was to quite a degree. And for that reason, I see the stock market as something of a bit of a dice game cum blackjack table. Our job as investors is to improve our returns by getting a statistical edge. Of course to do that, we’ll need to know what the probabilities are.

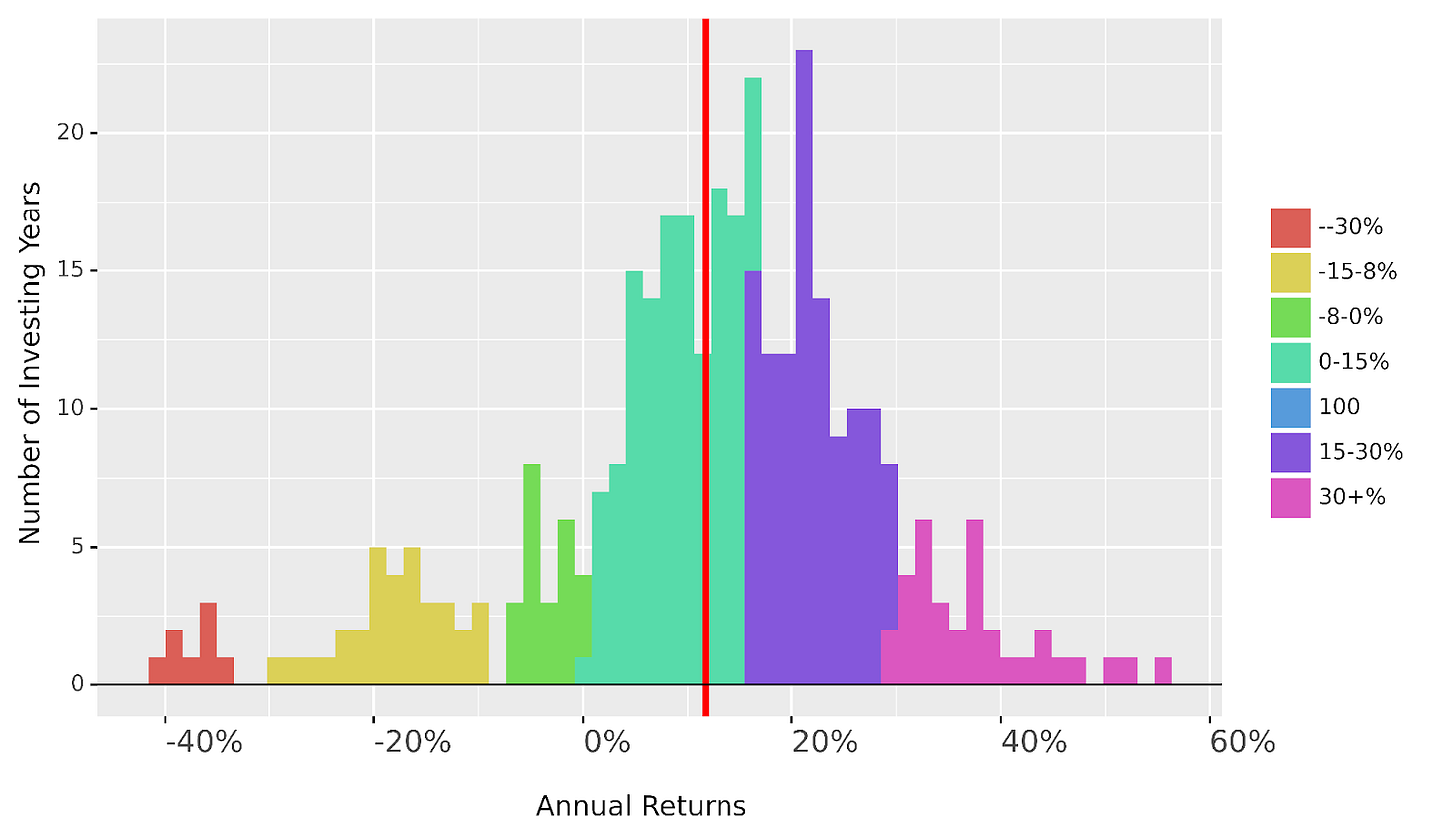

Just as we all know that the chances of rolling a 6 on a die are 1 in 6, we need to know the probabilities for getting returns on stocks are. By way of example, I’ve plotted a distribution of returns for the S&P 500 based on it’s all time history below.

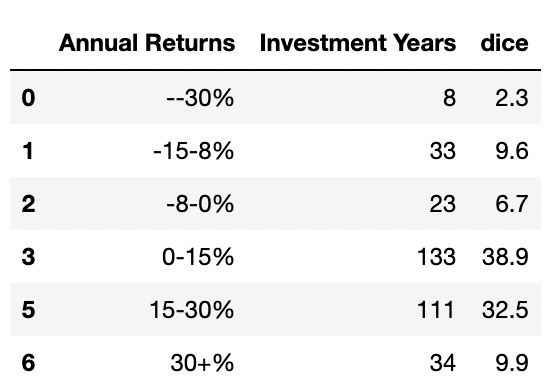

So if we imagine the stock market as a dice game where you buy a stock, only this die is not 1 in 6 to score an annual return of 30+ percent but 10% probability (1 in 10 chance). Most of the return is in the 0 to 15% range as supported by the average (the red line) of a 12% annual return. Let’s look at the full data table:

As you can see, to date investing in the S&P 500 means your chances of getting above zero returns are pretty good – 50% in fact! So if I invested £100, after 1 year we could expect £112 which is 12% on average. This method of evaluation is known as the expected value and assumes you’d be able to access all 6 annual returns in a year and then take the aggregate.

I’m afraid that isn’t quite the reality as you only get one dice throw!! That is assuming you start with the £100 invested but this time you roll only one die each time, you would actually expect your average annual return to be more like 10.4% which gives you a less impressive £110.

A difference of 1.2% annual return over a year, what gives? Over 1 year the difference seems nothing but it’s still an underrepresentation of reality and over a 20 year period is worth an extra 27%!

Multiverse Testing

Of course, that’s the dice roll in this life, but we don’t know which life we’re in do we? To be less cryptic, for this dice roll we don’t know what the annual returns are likely to be over the next few years, let alone (and most importantly) in what order.

But what if we could simulate the market (i.e. different orders) for different versions of us living in different multiverses? I haven’t managed to find a way to reach the other Tysons living in other multiverses, but I do know maths.

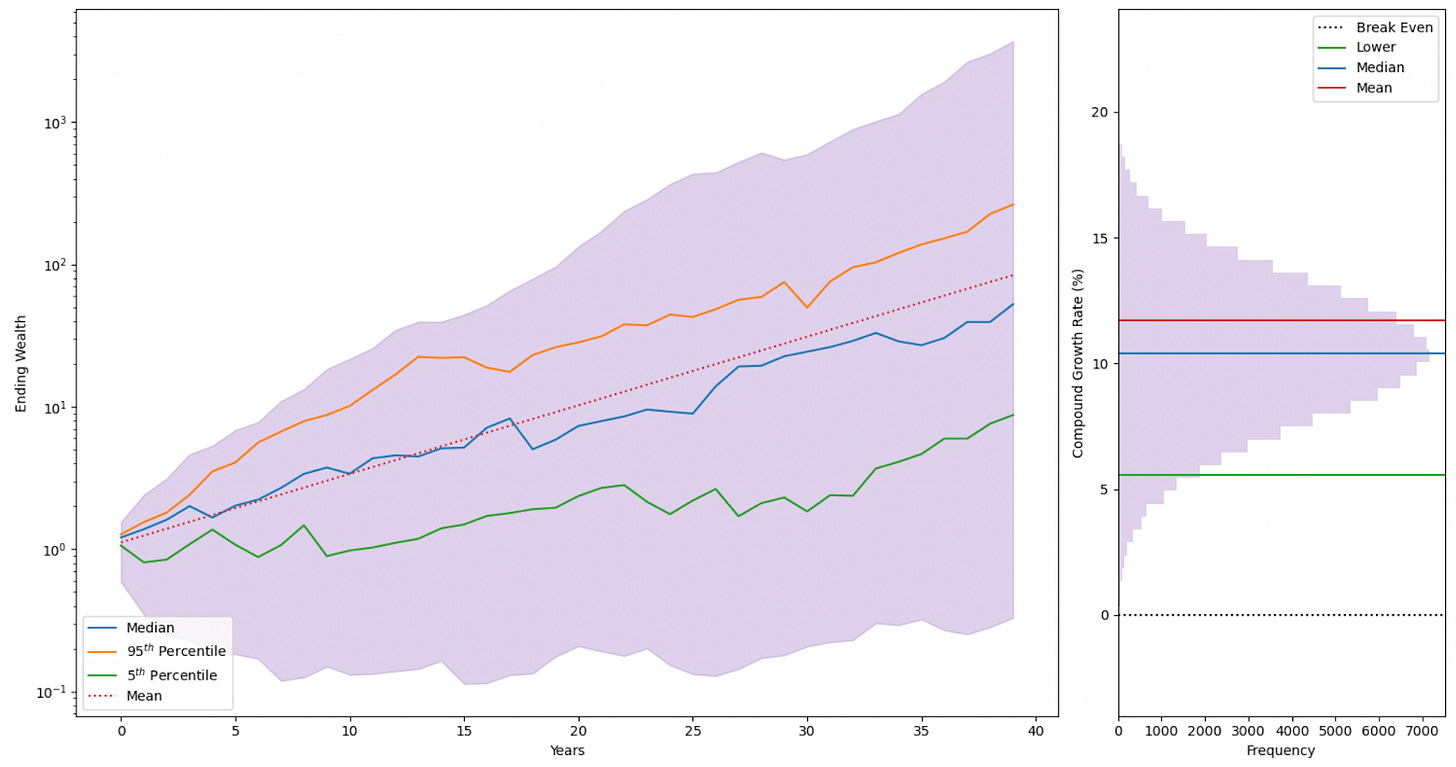

Let us simulate 100,000 multiverses where we have 100,000 Tysons investing the same single sum in the same stock and letting it run for the next 40 years (that’s 40 dice rolls per Tyson) – what is our expected annual return then?

So it seems like 50,000 Tysons out of 100,000 could actually expect a 10.4% annual return and is more representative of reality. If you’re unlucky (like the 5,000 Tysons or the lower 5th percentile), then you can expect 5.6% per year which doesn’t bear thinking in this high inflation economic phase.

You can also see how over time that you’re generally above zero annually throughout the 40 years

Using this perspective and the Monte Carlo simulation method helps me to evaluate investment ideas and stocks before putting out a tip. I’m not only interested in the average return, I’m also interested in minimising risk. And so if that means taking an ever so slightly lower median annual return for a much higher return for the 5th percentile, I’ll take it.

My inspiration

I’d love to say this was all my doing but the reality is that not all of these ideas are my own and I’m partly inspired by the book Fortune’s Formula by William Poundstone and A Man For All Markets by Ed Thorp (which is unputdownable – you’ve been warned!). I will be using Monte Carlo to test famous investment hypotheses put out by the gurus, so as ever – watch this space!

With fun and profit,

Tyson